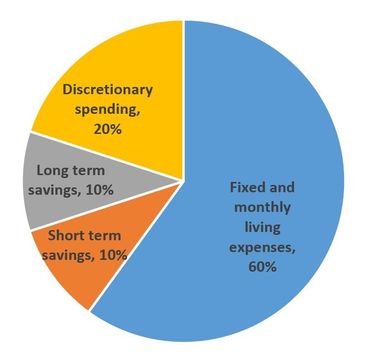

One of the most important things that you can do is create a budget. Where a lot of people come unstuck when it comes to building wealth is to spend their money first and save what’s left over. Instead you should do it the other way around. It doesn’t have to be complex, but know how much you make each month, and first deduct your fixed monthly expenses to work out how much is left. Ideally your fixed monthly costs shouldn’t be more than 50-65% of your monthly income after taxes.

You’ll then want to set aside at least 5-10% of your net income for long term savings or retirement and another minimum 5-10% for short terms savings. The rest is your discretionary spending (including your fun allocation) for things like nights out, clothing purchases, etc. But ideally you want as much of your money as possible working for you and making more money, not tied up in depreciating assets that don’t.

Three very important points to remember here:

- Don’t forget about your taxes. And yes we will be working to minimize taxes as much as possible, but as your investments and/or side hustle businesses grow and bring in more income (more on these later) there is likely to be some tax payable, especially if you cut the cord on your PAYG job. Make sure you set aside tax money from your income each month before your budget allocations so it doesn’t come as a shock at the end of the quarter or year.

- As your income grows, your lifestyle expenses should not grow in line. Yes, they will grow as you start to upgrade your lifestyle, but don’t become car and house poor, or spend 6 months’ worth of income on a Rolex watch. Wait until you can buy these things out of your monthly discretionary spending money without digging into your savings.

The 5-10% you are putting into short term savings and investments should however grow in percentage over time, ie: start when your income is low with 5% each month, then increase to 10%, then 20%, then 30% and even more as your income grows.

Your short-term savings initially is your emergency fund. Ideally you want to aim initially for at least 6-12 months of total income in your emergency savings account. That way if you lose your job or something bad happens you have money to tide you over until you can get back on your feet. Think of it as a type of self-insurance. Beyond this it should be used to fund investments and business start-ups.

If you are interested in a chat to review your budget and the best way to achieve your long and short term savings goals, I'm here to help. Reach out to request a

free consultation here.