The most important thing you can do to save for retirement is to start early.

Due to the amazing benefits of compound interest, the earlier you start, the less you need to set aside each month. Lets look at some of the different options available to maximize your investment returns while minimizing tax.

401K Retirement Funds

If you happen to be a W-2 employee, take advantage of any employer operated 401K match offerings. Never say no to free money. Plus, investing money pre-tax means that whatever your top tax rate, the government is effectively giving you an additional investment match of that percentage to grow and earn interest/dividends on. Don’t think they are doing this out of the goodness of their hearts however, they will take their share of your larger retirement account at most likely even higher rates on the way out the other end. Plus, they will force you to take it out on a schedule designed to facilitate them getting as much tax from it as possible. Someone afterall, will have to pay for the trillion-dollar stimulus packages.

Roth IRAs

Many people add to their retirement savings by using Roth IRAs which are invested from after-tax dollars so that the capital component will be tax free in future. The Government does of course limit both the amount of money you can contribute to these as well as how much can be accessed tax free.

The Magic of Universal Life Insurance

A third option, and probably the biggest secret of the wealthy - is universal life insurance.

In 1985, the tax code was updated to allow for investment gains to be held and grown inside a life insurance policy free of taxes. This provided a way for the wealthy to create new types of life insurance policies they could use under the guise of risk protection, to grow their money, while at the same time sheltering it from taxes.

This is where both the rich, and the banks, invest and shelter their money. The right types of life insurance policies can be used to invest money free of capital gains taxes with no tax payable on dividends or interest on any investments held within these policies. Even better, the proceeds can be accessed, via loans, at any age. These loan proceeds (which are not considered income and so don’t impact social security) are also not taxable, meaning that you can borrow your own money without paying any taxes on it and then pay off the loan with the death benefit when you die, leaving the balance to your beneficiaries. Death benefits are also not taxable. Pretty neat right?

Many wealthy people use these types of life insurance policies to fund their retirement.

For retirement investing, I like the IUL or Indexed Universal Life policy. As I alluded previously, your money grows inside the policy tax free and then allows you to borrow against it (also) tax free in future when you need it. The last thing you want to end up with is to find your retirement savings depleted by 30-50% in taxes because your retirement funds are now generating the same or more income than while you were working. The goal is not to just survive on less money when we get older right?

Use Indexed Investments to Protect Against Market Downside

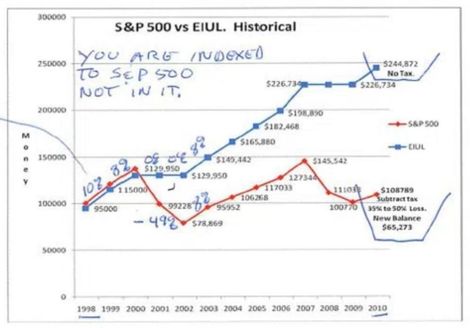

The other reason I like the IUL is that the I stands for indexed. This means that they are linked or indexed to the stock market for gains, but because they are not actually in the stock market, they do not take the losses. When the stock market goes up, the money in your IUL investment also goes up. When the stock market goes down however, your money does not take any losses. This will provide you with a higher average rate of return than the stock market in general over the long term.

The below illustration shows a comparison of an IUL (in blue) compared to the S&P500 which it is indexed to and the value of funds at the end of the 12 year investment period.

Don't Waste Money On Interest

My other favorite thing about the IUL is that these can be used to reduce and pay off faster your non-investment debts (the ones that aren’t working for you to grow more money – like your mortgage, your car loan and any outstanding credit card, medical or college loan debts you may have). You can do this by using your investment life insurance policy as your personal bank, borrowing money out of the balance to pay down the debts then snowballing your extra and minimum payments from each paid off debt back into the insurance policy to repay the loans, paying off your debts one by one in turn, including your mortgage. On average I’ve seen this strategy pay off all debts including the mortgage on average in 9-10 years (instead of 20-30), saving hundreds of thousands of dollars in interest. This saved interest money is then yours to invest, grow and earn more money with.

My last piece of advice before we move off the topic of long term investments is to diversify, diversify, diversify. I’m sure you have heard the saying to never put all your eggs in one basket, well it's good advice.

If you are interested in seeing more about how IULs compare to 401K investment performance over the long term, I made a couple of videos for you here: