If you want to be good at something, first find someone who is already the best at what it is you want to do and copy them – do exactly what they tell you.

Before we start, here is a pearl of wisdom for you. It’s not mine, and I’m not sure who said it first, but a lot of people who are both wealthy and exceptional at what they do live by this rule. If you want to be good at something, first find someone who is already the best at what it is you want to do and copy them – do exactly what they tell you. Then practice, practice, practice until you become great, the very best you can be.

This Blog is about building wealth, so I wanted to start by looking at the best at being wealthy, how they got there and how they grow wealth, even while they sleep.

Who Has The Money?

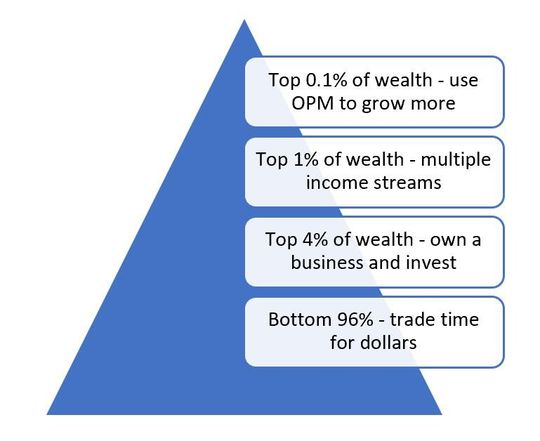

We can break down the ownership of wealth in this country into 4 main groups: the top 0.1% who hold over 80% of the wealth, the top 1% and the top 4% who share just over 10% of the wealth and the bottom 96% (ie: the vast majority of Americans) who between them hold less than 10% of US wealth.

You may not be surprised to learn that the 96% earn their money by trading time for dollars. If you are reading this blog, most likely you are one of them. It’s ok, I used to be too.

The first thing that I learned about this pretty quickly, is that yes, you can earn money (sometimes even quite a lot) from doing this. At one point I was earning around a quarter of a million dollars a year. However, earning money for someone else is not going to have you join the ranks of the super wealthy. Instead we need to learn to flip the transaction around and have our money work for us instead.

How Do We Learn About Money?

We learn how to handle money, often poorly, from our parents. There aren’t classes in schools or even in universities that teach wealth management or money growth strategies. Young adults aren’t taught how to balance a check book or how credit cards work. Let’s take a look at how learning about money varies between each of wealth class groups.

The (bottom) 96% in wealth ownership are taught by their parents to pay taxes, save their money in banks and earn good credit - which they use to accumulate things like large home mortgages, cars and swimming pools, handbags and designer clothes. They care what other people think, and they want to look the part.

The top 4%, in the wealth stakes, instead are taught by their parents to run a business, to protect their income against loss, to minimize the taxes they pay and to invest their money – using it to make more money.

The top 1% of the wealthy don’t just have a single business, they have multiple streams of income – ideally passive income. And rather than putting their money in banks (where the banks use your money to make more money for themselves), they become their own bank.

The top 0.1% of the wealthy, are additionally brought up to use other people’s money to invest and therefore earn exponentially even more income.

These are the financiers or finance capitalists. This is where the term capitalism originated from.

The Lipnicki Agency (and this blog) takes lessons from the wealthiest groups and make them actionable so that anyone, including wage earners can increase their wealth and secure their financial future.

Make sure you bookmark this website and follow me on social media for your weekly actionable strategies to grow your wealth.