5 Steps to Ensure You Are Debt Free Well Before Retirement: A Guide to Debt Free LifeR

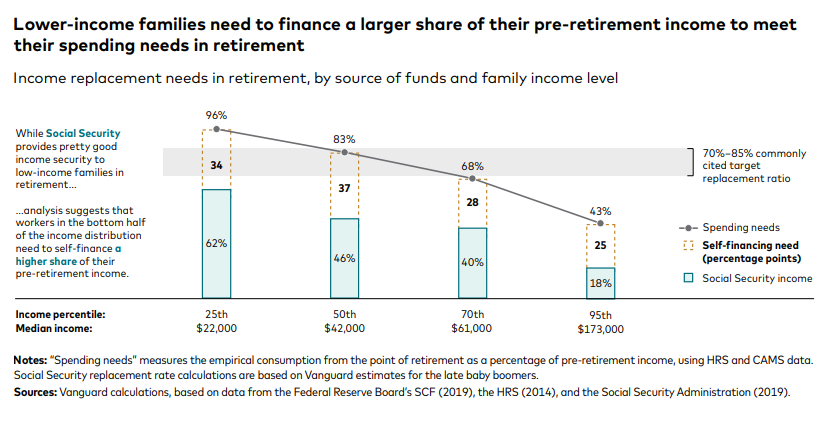

In my last article I walked you through my favorite strategies for increasing your retirement income (or bridging your retirement income gap if you have one).

Today we are talking in more detail about the Debt Free Life program offered through Debt Free Life certified agents with Symmetry Financial Group. Lucky for you, I happen to be one of those certified agents :).

Debt Free LifeR is a proprietary system that combines data science technology, traditional debt payoff methods, and the infinite banking concept to help clients use their money twice to pay off their debts faster and build their retirement nest egg at the same time without spending anything more. Imagine being completely debt free, including your mortgage in just 7-9 years or even less!

This article will outline the steps used by the Debt Free Life program to ensure you are debt free well before retirement.

Step 1: Analyze Your Debts

The first step in Debt Free Life is to analyze all your debts, including mortgages, credit cards, auto and solar loans, student debt, personal loans, and more into the system. The program uses data science technology to review your amortization schedules, interest rates, and payment details to develop a customized plan for you. This step is crucial to understand your current debt situation and determine the best strategy for paying everything off. To begin, meet with your certified Debt Free Life specialist who will enter all your debt information into the proprietary Debt Free Life platform.

Step 2: Combine With Traditional Debt Payoff Methods

Once your debts have been analyzed, the Debt Free Life program combines traditional debt payoff methods, such as the debt snowball and debt avalanche, to create a plan that maximizes your efforts. The debt snowball method focuses on paying off the smallest debts first, while the debt avalanche method focuses on paying off the debts with the highest interest rates first. The program determines which method, or even if a combination, is best for your unique situation. By using both methods, Debt Free Life can help you pay off your debts more efficiently.

Step 3: Use the Infinite Banking Concept

The infinite banking concept is a financial strategy that involves creating your own bank and playing interest rate arbitrage. Instead of paying interest to lenders, you use your money to pay off your debts and grow it tax-free for retirement at the same time, effectively using it twice.

Why should the banks earn interest on your money when you can instead? The Debt Free Life program uses this concept to help you pay off your debts faster and build your retirement nest egg simultaneously. This step is crucial to maximize the use of your money.

Step 4: Pay Off Debts Faster Saving 1,000's In Interest

Using Debt Free Life, clients are able to pay off all of their debts, including their mortgages, in an average of 17 to 25 years less than planned. This is because the program creates a customized plan that combines data science technology, traditional debt payoff methods, and the infinite banking concept to maximize your efforts. Given that mortgage payments can average somewhere between 20-30% of our monthly budget, this can make a huge difference in closing your retirement income gap. By paying off your debts faster, you will not only save 1000's in interest but you can save more money for retirement (or other purchases) and improve your financial well-being.

Step 5: Build Your Tax-Free Retirement Nest Egg

By using the infinite banking concept to pay off your debts and grow your money tax-free for retirement, you're able to build your retirement nest egg faster than if you were only paying off debts or saving for retirement separately. The program creates a plan that maximizes your efforts so that you can achieve financial freedom and enjoy your retirement without worrying about debt.

Are you ready to learn how Debt Free Life could work for you? Schedule a time with your Certified Debt Free Life specialist here and request your personal Debt Free Life Report.