Unlock the Secrets to Saving Thousands on College Tuition

The Importance of College Education

In today's job market, a college education is increasingly essential for most career paths.

Employers more often than not require college degrees as a prerequisite for employment. In 2017 less than 34% of jobs could be filled with a high school diploma, down from 75% in the 1970s2 and this number is continuing to drop. Even professions like firefighting now require a college degree.

The average college graduate will earn an average 75% wage premium over the average high school graduate and earn double the money over their lifetime3.

College is Expensive

Average annual college tuition fees in 2021 ranged from:

- $10,000 - $20,000 per annum for community colleges

- $20,000 - $40,000 per annum for state colleges (lower end if you live in the state)

- $40,000 - $80,000 per annum for private colleges

- $80,000+ for Tier one schools like Yale, Harvard, Tufts

The average student takes 5.5 years to complete their undergraduate degree1. The total cost of college for 5.5 years therefore ranges from over $50,000 to nearly half a million dollars.

Alarmingly, only 48% of college students graduate or complete their degrees1.

Paying for College is one of the largest financial investment any parent has to make. Over 68% of parents say they are worried about paying for college4.

The Financial Impact on Families of Rising College Costs

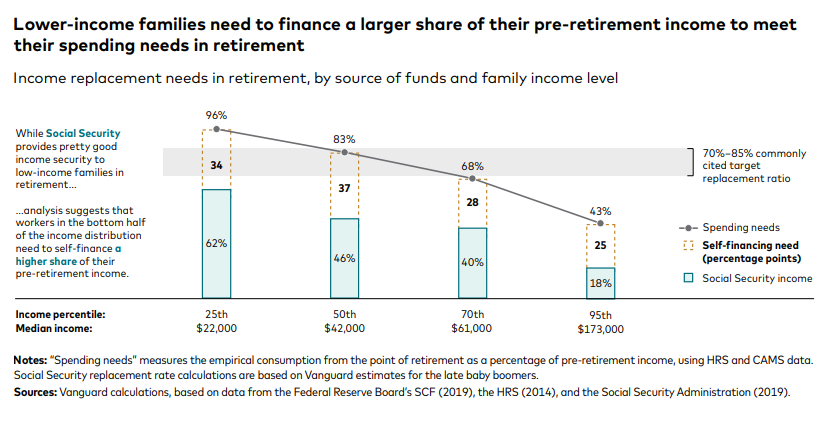

A survey in 2015 found that 30% of respondents had already reduced the amount of money they were saving for retirement, withdrawn from their retirement accounts to pay for college, or had delayed their retirement. Another 30-40% said they would take these actions in future.

40% of respondents also felt they had an obligation to help pay for their children’s and grandchildren’s college education5. While it's only natural that parents are willing to help their children and grandchildren get a good start in life, are they really doing their children a favor if they sacrifice their own retirement security and eventually become a burden on their children in their frail years?

I’m not sure if you have heard the term the Sandwich Generation? It refers to people who are simultaneously providing financial support for both their children and parents.

How To Pay Less For College

There are 3 things that you can do:

- Start as soon as you can

- Understand and Work the Process

- Get Help

By doing these things you will win in the following ways:

- Your annual tuition fees will be lower as a result of working the EFC/FIA formulas.

- You will pay less for the tuition you do have to pay by using an invisible college savings account and taking advantage of tax-free compound growth.

- Your child will be accepted into more and better colleges providing them with better career and earning opportunities.

- Your student will be better prepared for college and make better college and course selections.

- Students who go through this process with us, graduate on average graduate a full year earlier saving a year of tuition

- Our student graduation rate is 86% vs 48% of the general student population.

What would these benefits be worth to you?

And what if I told you that because ACF is a non-profit, the cost to you will much, much less than you’ll spend anywhere else and not receive all the benefits I listed above.

Lets Understand How College Funding Works

There are three main sources of college funding:

- Needs based aid

- Merit based aid

- Self-help aid - parent funding & student loans

When thinking about funding for college, it’s crucial to recognize that colleges are businesses.

The application process includes submitting financial information through the FAFSA and, for some schools, the CSS Profile, which the government and the colleges use to determine whether they will provide you with assistance paying for college.

· The FAFSA draws information from your tax return for income and also asks questions about your savings, investment accounts and assets.

· The CSS profile requests even more information about other assets you have they might be able to tap into for college funding and uses an even more parent unfriendly formula to calculate how much you have available to pay them.

It’s very easy to make mistakes on these forms. It's important to know too, that these forms are highly audited (up to 38% each year) to ensure you report everything you have. That’s why for our clients we provide you with a line-by-line guide with exactly how to complete them and what information goes where.

The forms use a very complex formula to produce what is called your EFC or expected family contribution. This could not in fact be further from the truth. This is the amount they believe you can easily pay based on income. As a result of the confusion, this will be renamed in 24/25 to SAI, Student Aid Index.

The formula for what you will actually pay looks like this:

College Attendance List Price

Less any in-state discount

Less Federal needs aid / grants

Less any college funded scholarships / awards

Less your EFC/SAI (generally what you have in college savings and extra income)

= Cost of attendance (generally expected to come from student or parent loans or student work programs).

Now do you notice something strange about this formula?

That’s right there are 2 lines for your contribution to college fees. Both the EFC and the final cost of attendance are paid by you.

Basically, once they have your federal and financial information, they use the college funded scholarships/awards to increase or decrease how much you will pay based on 2 criteria:

- How much they think you can afford.

- How much they want your student to attend their college – attractive student.

You’ll also note that there is no line for private scholarships or prizes. These currently make up about 3% of the money that pays for college tuition each year. Additionally, in case you are not aware, any of these you receive have to be reported to the schools in your FAFSA, which you have to update any time you receive additional money. What we see happen most of the time is that the schools then then reduce their scholarships or awards by the same amount to offset their value and keep your payment the same. Families in our program will receive coaching and support with how to successfully appeal these and we find they generally receive back at 50-100% of the original grant amount.

Important Points Regarding FAFSA Form and CSS Profile Information

- Financial snapshot taken 2 years before college, updated annually until graduation.

- Private scholarships, Inheritances, lottery winnings or other financial change must be updated, affecting EFC/SAI and awards.

- Retirement plans are no longer excluded from family asset calculations

- Net worth calculated without recognizing debts, making families appear wealthier

- No more discounts for multiple students from the same family in college

These changes makes it more important than ever to work with a college funding professional early to minimize EFC and the cost of attendance. I have seen this make huge differences to how much families need to pay, at minimum 10’s of thousands of dollars.

Now We Understand The College Funding Formula – Let's Work It To Our Advantage

These are the levers we have to work the formula to your advantage:

1. Starting early and Being first in Line

2. Invisible college savings plan

3. Reallocation of FAFSA/CSS Reportable income and assets

4. Have your child be an attractive student to obtain higher levels of college funded scholarships/awards

5. Analyze your award and appeal/ask for more

Start Early - Be First In Line

Colleges set both place and annual scholarship and award budgets each year. These are limited and handed out on a first come first serve basis, making early applications crucial. Being a front-of-the-line, attractive student increases your chances of receiving scholarships and awards from colleges exponentially.

Birth to Middle School College Planning

The earlier you start saving for college, the more you can benefit from compound interest and (in the right vehicle) tax-free growth.

Avoid using 529 plans for your college savings for the following reasons:

- 529 Plans are reportable on the FAFSA form and CSS profile so you are literally telling the colleges how much they can charge you.

- They are tax free only up to a maximum annual contribution limit.

- They are very inflexible – can only be used to pay for college. And yes you can now roll a certain amount over into retirement funds, but those are the only options.

- To access the money for anything but eligible education expenses, you will pay full tax rate on it plus an additional 10% penalty.

Instead, I recommend using an Invisible College Savings Plans like Smart Start. These plans come with the following benefits:

- These plans are not reportable on the FAFSA or CSS, so not included in the calculation of how much you have available to pay for college.

- Tax free growth with no funding limits.

- Very flexible – they can be used for college, to buy a car, deposit on a home, start a business, for income or for anything you like.

- When you are ready to use your money you take it as a loan – rather than a withdrawal meaning not reportable and no tax on that either.

- You can continue to fund and draw lump sums or income for as long as you like.

Smart Start plans can be established based on the amount each month you would like to save, or the target amount you would like to have saved for college. They are also very flexible in terms of being able to adjust or pause contributions on a month-to-month basis if needed.

INSIDER TIP: Take the student loan option and keep saving (or at least have the value compounding) in your invisible college savings plan right through the years your child is in college. Remember student loans are interest free with no payments required until the year after graduation. You might as well use the student loan credit for free to grow your plan’s tax-free compound growth as long as you can.

Freshman & Sophomore Years

The Freshman and Sophomore years are key for laying the groundwork that colleges want to see in your application. Planning early is crucial for maximizing chances of getting into a top-tier college and landing a sizeable scholarship from the college of your choice. Key actions for these years include:

- Start career planning, identify activities and subjects of interest. Utilize the eCollegePro careers module for personality and aptitude testing.

- Participate in extracurricular and volunteer activities.

- Take high schools courses/subjects rated more highly by the colleges

- Begin considering college characteristics such as specialties, location, size, and extracurricular activities.

- Utilize the ACF database to search for and apply for scholarships.

REMINDER: The Sophomore/Junior calendar year is the snapshot used in the FAFSA form and CSS profile. Asset reallocations and planned expenditures should happen before or during sophomore year to minimize your EFC. Consult a college funding financial professional to optimize financial position.

Junior Year

Although financial changes are now limited, there's still time to improve the academic and social aspects of the college application process. Consider these steps:

- Refine career planning using tools like the eCollegePro software's careers module.

- Continue participating in extracurricular and volunteer activities.

- Narrow down your list of colleges of interest, aiming to apply to at least 6-10 schools.

- Start SAT, ACT Test Prep using eCollegePro's comprehensive Test Prep module. Aim to take the tests multiple times, improving each time using eCollegePros different learning style formats which help every student succeed to practice and improve on their scores over time.

- Schedule campus visits during the academic year to get a feel for campus life while school is in session.

- Make appointments to meet and wow the admissions and financial aid officers of the schools you are considering.

Senior Year

Here's a month-by-month breakdown of key actions for the senior year:

- September: Submit admissions applications to at least 6-10 schools - be first in line.

- October: Complete and submit FAFSA and CSS funding applications - on exactly October 1st for best results.

- November: Receive and review your Student Aid Report (SAR).

- December: Apply for private sector scholarships open to seniors.

- January: Accept all college admissions offers as they come in.

- February: Personally thank providers of any scholarships received.

- March: Receive and interpret college award letters with ACF's assistance.

- April: Appeal for award re-evaluations and additional funding, your college planner will analyze awards against student profile & college data.

- May: Finalize college selection and submit loan applications.

- June: Notify non-selected colleges of your decision.

How American College Foundation and Your Advanced Certified College Planner Can Help

We have successfully helped families save tens of thousands of dollars in tuition every year. The most important things you can do to pay less for college include:

- Be first in line and start as soon as you can.

- Understand and work the process and financial formulas.

- Get professional help from organizations like the American College Foundation and the certified college planners who work with them.

The cost of the eCollegePro program is just under $1500 for a lifetime license for each student and their parents, providing invaluable guidance and support for a very low investment, setting your child up for a lifetime of success. eCollegePro is available for families to purchase/gain first student access between final year of middle school and junior year of high school.

ACF every year buys the admissions and funding data from all the colleges in the country. We know how much each student paid, what their grades were, which subjects they took in high school, how much funding they received from where, how much was paid in student loans, the school’s acceptance rates and yields, as well as their graduation rate and loan default rate.

Please note that we don't work with every student. First step will be an interview with the student to determine if we believe we can make a difference and help you pay less and get into a better college than you had originally thought. There will be some work and commitment on behalf of the student to ensure success. If you are interested in working with us, please schedule an appointment for a Free College Planning Process review here.