6 Tools You Can Use To Achieve a Debt Free Life!

As of February 2023, Americans have amassed more than $925 billion in credit card debt. Yes ‘Billion’ with a ‘B.’ In addition, variable mortgage rates practically doubled in 2022 while student loan debt has hit a staggering federal balance of $1.64 Trillion (which accounts for over 92% of all student loan debt).

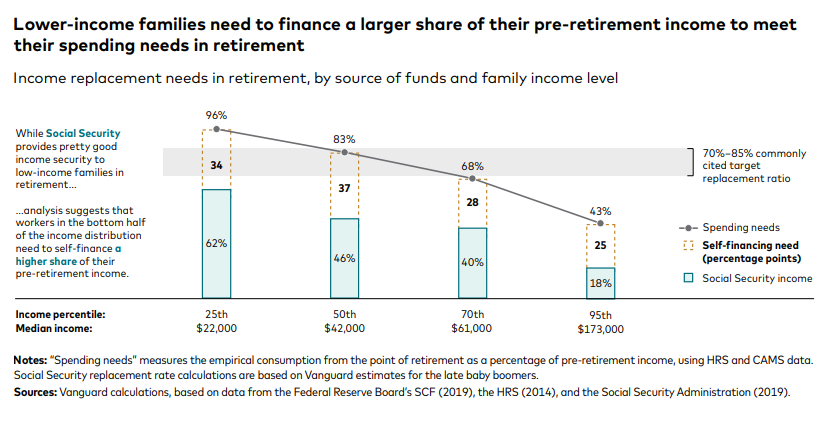

Unfortunately our consumer based society encourages us to take on more and more debt. After college and our student loan payments kick in, there is the wedding which more couples now take out loans to pay for themselves, then we purchase a home = mortgage debt, after that we take on car leases, get credit cards, and now solar loans. And I haven't even mentioned medical debt. As a result, many Americans are having to dig themselves out of a debt-sized hole that gets bigger every day as the cost of living increases and the average wage lags much further behind. This sadly leaves little room to even think about saving for retirement.

There are however solutions you use to help eliminate debt and tackle your financial goals. Here I will break down six tools you can use to achieve a debt-free life.

#1: 50/20/30 Budget

When it comes to eliminating debt, focusing on your eventual goals is critical to the success of the strategies you use.

The 50/20/30 budget refers to the percent of your monthly income that you allocate. This budgeting tool uses three categories: “needs,” “wants” and “savings/debt", as follows:

- 50 percent of your monthly income should be allotted for needs (bills, groceries, living expenses),

- 20 percent should be spent on wants (entertainment, eating out or a new pair of shoes you might not need).

- 30 percent of your income should be focused on savings and paying off debt.

The nice thing about this method is its simplicity. It uses an easy formula to draw boundaries on how your monthly income should be spent. More than that, it’s not a particularly rigid budget, so it’s easier to stick to.

#2: Snowball or Avalanche Debt Payoff Methods

There are plenty of methods for tackling debt. Some methods give you time to slowly chip away at your loans, while others require more financial sacrifice to eliminate them in less time. The snowball and avalanche methods (respectively) provide two dollar efficient choices on how to get some quick wins which provide incentive to keep going.

The snowball method is designed for people that struggle to put more toward their loans. By ordering your debts from the smallest to largest and tackling them one at a time you can build momentum to eliminate your debts systematically. The snowball method is ideal for individuals who are motivated by the easy progress of paying off smaller debts first then working toward larger loans.

The avalanche method takes a more fast-paced approach to eliminate debt. With the avalanche method, you will focus on your loans with the highest interest rate first and work down the list. While paying the minimum payments on the rest of their debt, the avalanche method is best for clients who have more disposable income. You won’t see as much initial progress as using the snowball approach, but you will ultimately pay those loans off in less time than other methods due to the interest saved.

#3: Tracking Spreadsheet

Simple and effective, spreadsheets are a great way to keep track of expenses, financial goals and debt. Everyone can benefit from keeping a detailed account of where their money is coming from and what it’s being used toward.

By maintaining these details, you can manipulate the spreadsheets to understand when certain loans can be paid off and what small changes to your spending will speed that process up. Excel and Google Sheets are both great inexpensive options, and you can find plenty of free resources online to sharpen those spreadsheet skills.

#4: Find a Budgeting App

At the end of the day, few tools get it done like phone apps. They’re typically easy to use and always within reach, and for that reason, they’re a great resource for understanding your debts and finances. There are apps for budgeting, monitoring spending and even rolling your pennies into savings which add up to amounts you can use to make large, one-time payments.

More specifically, apps like Quoin and Undebit.it are virtual debt pay-off tools that you can use for thoroughly automated debt tracking. Both options will help track your income and payments while offering a list of strategies they can deploy to tackle them.

Both these apps do require payment, but there are a host of free budgeting apps that they can use instead. I mentioned a couple of them in my last article about managing your money like a CFO here.

#5: Work with a fiduciary

Working with a fiduciary is a great option for people who feel more comfortable letting others take the debt elimination wheel. A fiduciary can be a family member, trusted co-worker or experienced professional — like me - to help guide you through the debt payoff process.

Whomever you choose, your fiduciary has the role of finding the best investment vehicles and money management services to ensure the best outcome for you the client.

While these services have traditionally been expensive, our parent company, Quility, has created Quility Financial Advisors (QFA), providing financial planning for middle America.

Regardless of your financial situation, a trusted financial professional can help pinpoint where you can improve your financial portfolio and look for products to help you meet your goals.

#6: Debt Free Life ®

An example of one of those products, Debt Free Life (DFL), is our proprietary answer for debt elimination.

DFL harnesses the power of a life insurance policy to help you achieve financial freedom without spending more than you already are and in fewer years than it would traditionally take. As a Debt Free Life Certified agent, I can help you create a payment plan that will systematically tackle your debts using tax-free loans from the policy, all while the same money accumulates tax free growth and dividends. You get to use your same money twice so that at the same time as you are paying down your debts, that same money is earning you more for future cash flow needs or retirement.

If you are interested in learning more, reach out for a free debt elimination consultation. I'll create you a free debt elimination Debt Free Life report so you can see just how much time and money you can save by paying your debts. Most of my clients are able to pay off all their debts including their mortgage in 30% of the time or less.

To learn more you can watch this series of videos that walks you through the Debt Free Life process: