7 Easy Steps to Calculate Your Retirement Income Needs

One of the critical steps in planning for a comfortable and secure retirement is determining how much income you'll need to maintain your desired lifestyle.

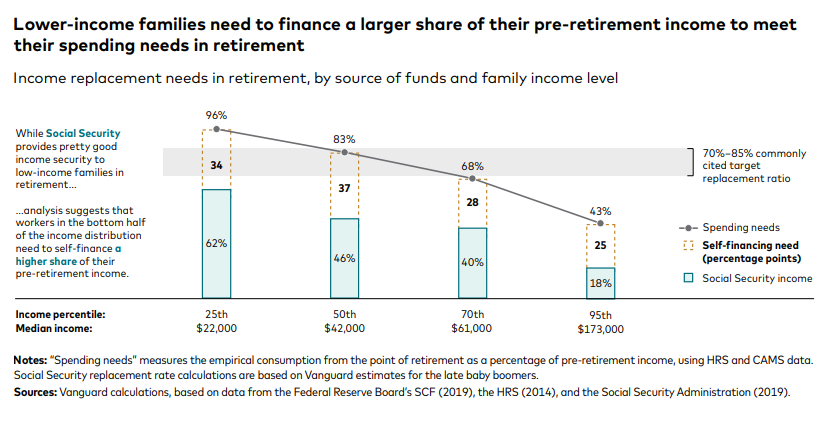

Many financial advisors, since you won’t be working then, calculate your retirement income needs at around 75% of your current living budget. I don’t know about you, but when I stop working I plan to do more than today. I would like to travel and see more places, try new experiences, participate in more activities and hobbies, eat out more often. None of those things are free, so in my mind I’m going to need more income in retirement not less.

This article will guide you step by step through estimating the amount of future income you’ll need. A future edition will cover planning to achieve that income, but for today let's just take one step at a time.

Step 1 – Analyze Your Current Expenses

My last newsletter broke down how to make a monthly budget by managing your money like a CFO. You can go back and review that article on the link left if you don't yet have a budget or clear idea of your current expenses for this step.

Step 2 – Picture Your Future

One of my favorite ways of picturing the future of any kind is through a vision board. In the old days we used to get nice big sheets of craft card and cut pictures out of magazines of our goals or desired outcomes. For my retirement it will be: things like tropical beaches, trying new restaurants with my husband, traveling to countries I’ve never been to and more. These days you can use Pinterest, Evernote or some other kind of online vision board if you prefer, however there is nothing like sticking your vision board to the refrigerator to remind and reinforce your goals.

Make sure to think about things like: where you’ll live – will you own your home or rent. Will you have more than one home. How you’ll get around, will you own a car, will you need a new car. How often will you travel and where to. Will you join a country or golf club, or take up painting and art classes. Do you want to be able to help your family out financially, etc. Write down all the extra expenses you'd like to include.

Step 3 – Adjust Your Living Expenses For Your Future Lifestyle

Now that you have a good idea of your desired future lifestyle and activities, it should be pretty easy to look at your current budget and adjust it to remove expenses you’ll no longer need in retirement and add in the new fun ones you’ll have instead.

Step 4 – Account for Debt Changes

An important factor that makes a big difference to both how much you can save along the way and how much income you need in retirement is debt. In particular long term debt. The original idea of 25-30 year mortgages was to both make payments affordable as well as enable home buyers in their 30’s to become mortgage free by retirement. Unfortunately the pandemic and rising costs of living have thrown a spoke in the debt free retirement dream for many, and the availability of lower rate refinancing enabled many to refinance their mortgages at lower interest rates but at the cost of new 30 years terms which now push well into retirement. In addition, many have added HEILOC loans, solar leases, car leases and other financing to their budget burden.

A Quility program which enables you to become your own bank and use your money twice to both save for retirement and pay off debt 2-3 times faster without spending anything more, saving you thousands in interest is Debt Free LifeTM. I’ll cover how that works in more detail in a future newsletter.

Step 5 – Account for Future Healthcare Costs

It’s important to factor in both health insurance costs – which as you know increase as you age, and the cost of care itself. Did you know that 72% of people over 65 will need long term care at some point? The average long term care facility costs on average $100-$150,000 per year. You can offset these costs of course with insurance, and in that case the younger you purchase insurance, the less expensive it is.

Don’t forget also about preventative healthcare and wellness programs. As we age staying fit, strong, eating whole unprocessed foods and having regular wellness checks can help prevent many diseases. Hormone replacement and other anti-aging treatments can also help slow down the aging process and extend our healthy active years. It's important to budget for these too.

Step 6 - Factor in Inflation

Inflation can significantly impact your future purchasing power, so it's crucial to incorporate it into your retirement income calculations. You can use historical inflation rates as a guide, but keep in mind that future rates may differ. Adjust your projected expenses for inflation to ensure your retirement income will cover your future cost of living.

Step 7 – Account for Taxes

Given the current state of US debt and the slowing birth rate in this country, do you believe taxes will go up or down in future?

It used to be said that you don’t have to worry so much about taxes in retirement because you’ll be earning less so will have little tax to worry about. However as we already established, many people intend to have more income in retirement not less. Additionally it is very likely that taxes will also be increased above current rates. Make sure to calculate what your before tax monthly income requirements might be given current tax rates and then build in a cushion for future tax increases.

Your Monthly Retirement Income Goal

Once you have made all 7 calculations and adjustments you now will have a monthly retirement income goal - congratulations! Make sure to add it to your vision board, to keep it top of mind.

The next step is putting in place a plan to achieve it. That will be the topic for my next article.

In the meantime, don’t forget to regularly review and adjust your estimates. Your retirement vision and income needs will likely change over time as changes to your personal situation and life goals do. Know that’s ok. Plans are made to be updated and improved upon. It is better to have a goal and regularly review and adjust it than not having one at all. Waiting to create a goal and plan until you know for sure, will surely lead you nowhere, or even worse, somewhere you do not want to go.

If you have any questions about creating your retirement income goal or need help with any of the steps, I'm here to help - don't hesitate to give me a call.